We often talk about the importance of relationships in business, education, and community work. But sometimes, it only takes one connection to spark something so much bigger than anyone could have imagined.

That’s exactly what happened when Rachel Barker, a CRA Program Manager at UMB Bank, reached out to her former colleague and friend, LaTasha Jacobs, Executive Director of Pathway Financial Education.

The two had worked closely at UMB — LaTasha in community development and Rachel in corporate compliance. Their paths crossed regularly, especially when it came to aligning development efforts with Community Reinvestment Act (CRA) priorities. They didn’t just share job functions; they shared values. Both believed in using their positions to build stronger, more financially empowered communities.

Even after LaTasha left the bank to lead Pathway, their connection remained intact. They checked in from time to time, sharing updates, ideas, and opportunities. And that’s what made all the difference.

A Request, a Recommendation, and the Spark of Something New

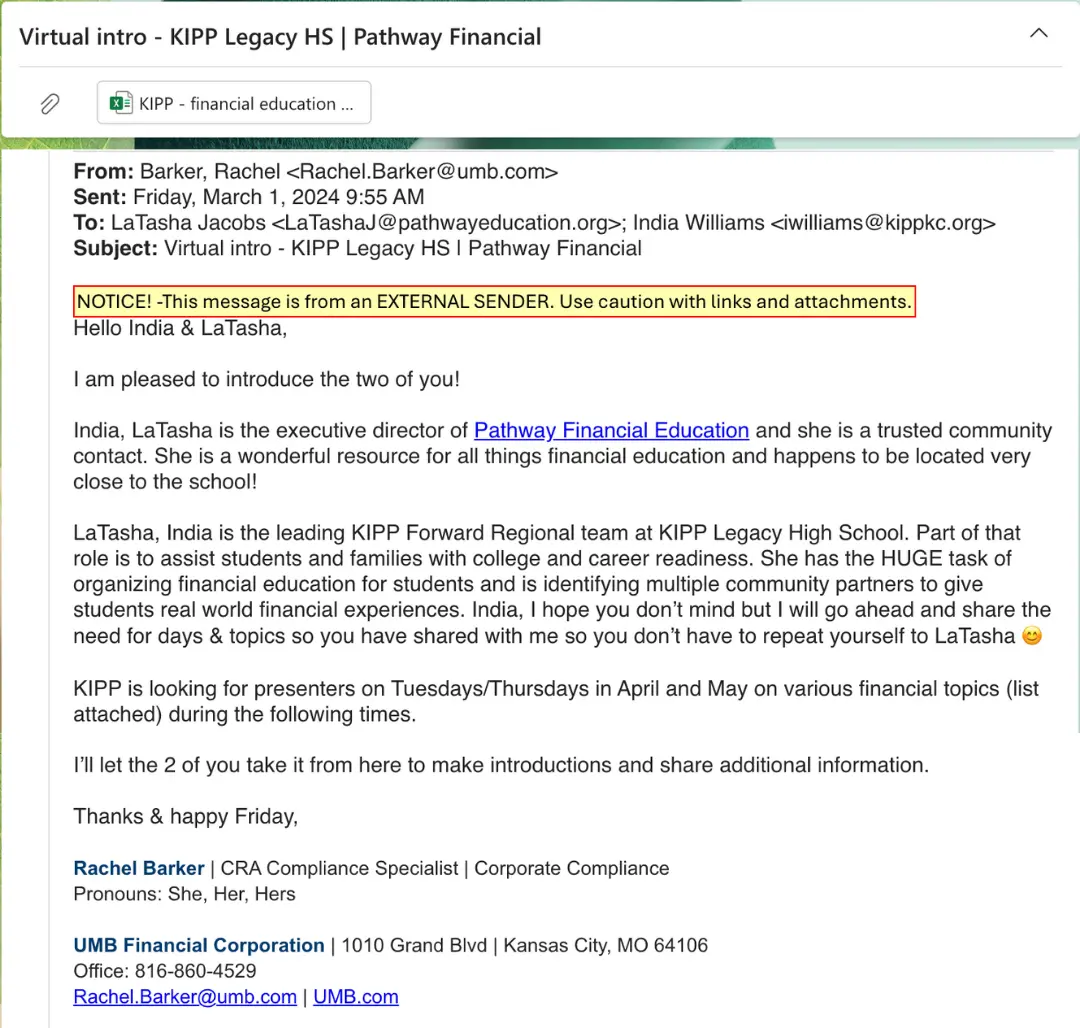

One day, Rachel received a request — one of many that banks like UMB receive on a regular basis. This time, it was from India Williams, Director of KIPP Forward at KIPP KC. India was searching for someone who could lead financial education programming for the junior class at KIPP Legacy High School. She wasn’t looking for a one-time presentation. She wanted a partner, someone who understood how to meet students where they were, and who could offer meaningful, relevant lessons that would stick.

Rachel immediately thought of Pathway.

She knew what LaTasha and her team were doing: offering free, high-quality financial education that was accessible, community-centered, and already making an impact. So, she made the connection. And within weeks, India reached out to Pathway and the collaboration began.

That one email set off a ripple effect no one could’ve predicted.

A Ripple That Keeps Growing

The partnership with KIPP took off quickly. Pathway brought in a youth-focused curriculum and real-life financial lessons that resonated with students. But what began as one school’s program soon evolved into something much bigger.

Because of that single introduction:

- Pathway is finalizing plans to return to KIPP for the 2025–2026 school year.

- Conversations are underway to bring our curriculum to Blue Springs School District in Jackson County, Missouri.

- A private school in California is exploring a pilot, thanks to a parent who works at Creative Planning. His daughter is a 6th grade teacher, and he’s interested in introducing a few modules to her classroom to see how students respond — with the hope of expanding from there.

- There have been high-level discussions with Kansas City Public Schools about supplementing their personal finance curriculum.

- A growing number of community organizations and nonprofits are asking Pathway to speak to youth — some as young as six years old.

The message is clear: the demand is there. Schools and communities are hungry for practical, inclusive, and empowering financial education and Pathway is delivering.

Scaling a Mission That Matters

As the demand continues to grow, we are preparing to launch a “teach the teacher” model allowing school districts to bring the curriculum into classrooms themselves. The curriculum, which already exceeds Missouri state standards, will be paired with opportunities for community members and volunteers to share their stories, support facilitators, and keep the human element at the core of each lesson.

This hybrid approach will allow Pathway to reach more students than ever before, without losing the heart of what makes our programming so impactful: connection, context, and community.

Growth Requires Support

To the public, this trajectory might look like magic, like a snowballing success story driven by momentum and mission. And while that’s partly true, the reality is more complex.

Behind the scenes, Pathway is doing the hard work of balancing explosive growth with sustainable support. Every new school, student, and opportunity requires not only staff capacity and curriculum development, but it also requires funding. It requires volunteers. And it requires partners who believe in the power of financial education to change lives.

The momentum is real. The interest is real. The outcomes, like students learning to budget, save, plan, and dream, are real. But none of it is possible without people who believe in the power of connection.

One connection changed the trajectory of Pathway’s youth programming.

Now imagine what dozens, or hundreds, of connections could do.

Rachel Barker’s introduction lit the spark. Now, with the right support, Pathway is ready to fan that flame into something much bigger: a future where every student has access to the financial tools they need to thrive.